EPM Talk Ep. 78 – ResusTEE with Felipe Teran

On this week’s podcast we interview Felipe Teran (@FTeranMD) who is on the bleeding edge…

On this week’s podcast we interview Felipe Teran (@FTeranMD) who is on the bleeding edge…

Dear Director, I work in a high-volume ED and get productivity pay. While the pay…

The Case A 65-year-old male presented to the emergency department out of concern for bleeding…

This episode on EP Talk we get into the details of the Erector Spinae Plane…

In this episode Mark Plaster (@epmonthly) and JD Landon (@emdocjd) review a single center series…

Utilizing a life-casted soft tissue foreign body removal trainer Managing soft tissue foreign bodies (FB)…

In this episode Mark Plaster (@erdocmark) and JD Landon (@emdocjd) talk about the impact that…

On this episode of EPM Talk, Mark Plaster chats with Dr. Jeff Johnson, the medical…

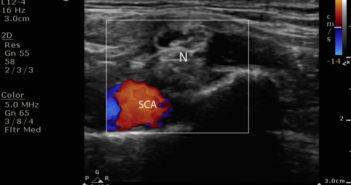

Exploring ultrasound guided peripheral nerve block in the emergency setting Introduction: Phantom limb pain (PLP)…

If anyone is still looking for a 2024 New Year’s resolution that does not involve…