Sometimes relocating for a new job means buying a new house at precisely the wrong time. Here are a few strategies I learned the hard way for buying a home when the market is against you.

Sometimes relocating for a new job means buying a new house at precisely the wrong time. Here are a few strategies I learned the hard way for buying a home when the market is against you.

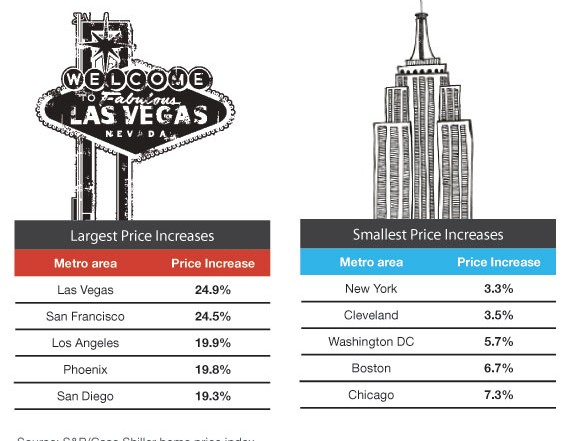

I really suck at timing the housing market. I bought my first house when it was a seller’s market, sold it earlier this year when it was still a buyer’s market, and just bought another home when it’s….you guessed it…a seller’s market again! Over the past 12 months ending June 2013, housing prices across the 20 largest cities are up about 12.1%. Take a look at the areas with the largest and smallest housing price increases:

No wonder my buying experience was a roller coaster ride. Let me share with you some lessons I learned along the way:

Lesson #1: Be flexible…really flexible

When I bought my first house, I looked at it three times before I made an offer. I scoped out the neighborhood, schools, and surrounding areas during the day and night. I made sure that the house met ALL of my criteria.

Not so this time.

The inventory of homes on the market had dropped by over 70% in the area I moved to, resulting in big price increases and slim pickings. There was no such thing as a second look. If you liked a house, you put an offer on it right then or it was gone. In the zip codes we wanted to live, there were houses that would come on the market in the morning and be under contract before the close of business.

So I expanded my criteria. While I wanted 5 bedrooms and a three car garage, maybe 3 or 4 bedrooms and a two car garage would be acceptable. Armed with an open mind, my wife and I put an offer on a house as soon as it came on the market…without physically seeing the house! Yes, I know that seems reckless, but to win the game, you gotta take some risks.

Problem is I still lost; within hours half a dozen other offers came in above mine. Maybe it was time to develop a new game plan. With our next attempt we placed offers on multiple properties at the same time–sort of like throwing your fishing line out and seeing what bites.

Lesson #2: Mortgages are overrated

My move across the country was pretty fast since my wife’s new job started less than 3 months from the time she accepted the offer. Getting a house I’ve lived in for eight years ready to sell within weeks was a herculean task. I was afraid it would sit on the market for months. While it sold within weeks, even if it didn’t sell and was still on the market today, it wouldn’t have affected my decision to buy a new house too much because I didn’t owe any money on the old house.

While others were boasting about their low mortgage interest rates, I was quite content with having a zero mortgage balance. That’s a great position to be in and gives you tremendous flexibility in your financial life. If I bought a new house without selling the old house, and I still owed a mortgage on the old house, you bet I’d be sweating. But with no mortgage to worry about and limited time, I could afford to buy another home.

Lesson #3: Short sales aren’t short

My wife moved several weeks before I did and started looking at houses. Then one day the call came. She looked at a house that exceeded our criteria. But I hadn’t seen the house since I was still living across the country so I was trusting her that this was the one. After all I had already placed a failed offer on the first house without looking at that one either, so may as well do the same thing on the next one right?

This time we were ready. We offered the full asking price and we waived all contingencies (including an appraisal!) except the home inspection. Now I was playing in the big leagues.

Just one problem. The house was a short sale transaction, not a traditional sale. In a short sale transaction the seller requests their mortgage lender (bank) to forgive the difference between the mortgage balance and the selling price. In this case the seller had two loans on the property (not good), and the banks were set to lose over $150,000 on the deal. With a short sale, you’re really negotiating with the banks not the seller.

The banks are in full control of the process, including whether they approve the deal, and at what price and time frame. They don’t give a damn about me the buyer. In fact the banks can still accept other offers along the way, and they can ask for more money than the original asking price. And you get the house as-is. With the housing market heating up and lots of competition, this was a big gamble.

Months passed. During that time, one bank approved the deal quickly but the second bank dragged its feet. Then the second bank approved but the first bank’s deal expired. We had to start the process over again. In the meantime, they threatened to put the house up in a foreclosure auction, in which case the short sale deal would fall apart. After several months both banks finally approved the deal and didn’t ask for more money.

But they wanted the money quickly. I waited months for the banks to approve the deal, but they wanted my money in a few days.

Lesson #4: Cash is king

I had been preapproved for a 15 year fixed mortgage loan at a ridiculously low rate of 2.6%, which was near the record low. Unfortunately that rate lock expired after 30 days during which time interest rates spiked up. Plus it just wasn’t possible to process a loan within the time frame the banks wanted. Otherwise the deal would fall apart and we’d have to find another house and pay more since the housing market continued to go up in the interim.

What to do? Well, there was only one option left: pay off the house in cash and screw the loan. And that’s exactly what I did.

Before you think that was foolish, you have to understand that when I sold my old house, I received a chunk of cash in my pocket since I didn’t have a mortgage. That cash wasn’t enough to pay off all of the new house so I had to come up with some more out of my savings, but if you’ve done a decent job of saving and investing for a while, you come to point where you’re in control of your financial life. And better yet, from day one I own my new home free and clear. No mortgage yet again.

Lesson #5: Real estate agents aren’t human anymore

None of this could be possible without the power of the internet and smartphones. In a fast moving housing market, what saved me is a website called Redfin. It’s like having a virtual real estate agent in your pocket. Redfin is available in large metro areas. It’s not only a website that shows you which houses are for sale, but it notifies you almost immediately when a new house comes up for sale, when a price changed, or when the status of a house changed (back on market vs. under contract). In fact the house we bought was under contract with a different buyer, but then that deal fell apart. Redfin notified me immediately that it was back on the market, and just like that I made an offer. Redfin also affiliates with certain real estate agents who will give you a rebate on the purchase price of the house. I highly recommend it if you’re in the market for a new house.

Setu Mazumdar, MD, CFP® is board certified in EM and he is the president of Physician Wealth Solutions.

www.physicianwealthsolutions.com