You’ve heard that taxes are going to increase and you’re waiting for the hammer to drop. We break down the new tax brackets and regulations that will impact you in the coming year.

You’ve heard that taxes are going to increase and you’re waiting for the hammer to drop. We break down the new tax brackets and regulations that will impact you in the coming year.

Last month we went through our annual ritual of filing our income tax returns. This sounds a bit strange, but I wish I could file 2012’s income tax return all over again this year, and next year, and the year after that. Why? Because last year’s tax liability was significantly lower than what you’ll be paying this year and from hereon forward. Lets take a detailed look at the tax changes so that you will know why your wallet feels lighter.

Income Tax Rates

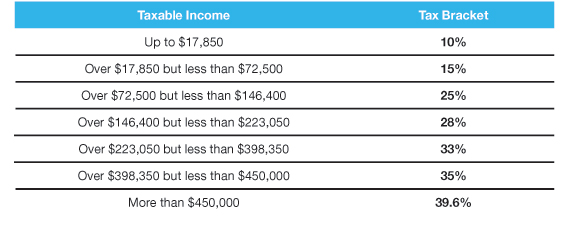

The new tax law, called the American Taxpayer ‘Relief’ Act of 2012, now defines “rich” as making $450,000 in taxable income or more. Before this year there were six income tax brackets, but that’s been expanded to seven, with the addition of a 39.6% bracket. Here’s an estimate of how this breaks down for a married couple:

Let’s think about what this means. I’d say most of you fall into the 33% bracket, but remember you’ve got to tack on your state income tax. If we assume you pay about 5% in state income tax, then you’re paying about 38% in total income taxes on the amount of income that falls in the 33% bracket. For you evil rich EPs making more than $450,000 you’ll be at nearly 45%. Live in California or New Jersey? Try 50%.

Payroll Tax Triple Play

You’re not even close to done. For the past two years if you were an employee, you got a temporary reduction in your payroll tax (Social Security tax) and paid 4.2%. That’s now been upped back to 6.2%. There’s a cap on the amount of income that is subject to Social Security tax, but this year that amount has been increased from $110,100 to $113,700.

And to really nail it in, if you make more than $250,000 (married) in wages, thanks to Obamacare you’ll be subject to an additional 0.9% Medicare tax on top of the 1.45% you already pay as an employee. One more thing to remember is that unlike Social Security tax, there’s no cap on Medicare taxes.

Dividends and capital gains

If you own investments in taxable accounts, the rules for dividend and capital gains taxes have become more complex (imagine that). There are now three dividend and capital gains tax rates:

- 0% if you fall in the 10% or 15% income tax brackets

- 15% if you fall in the 25% to 35% income tax brackets

- 20% if you fall in the dreaded 39.6% income tax bracket

On the surface it looks like only the last tax bracket gets hit with higher dividend and capital gains taxes since prior to this year everyone above the lowest two income tax brackets paid 15%. This is where Obamacare strikes again. If you make over $250,000 (married) then you’ve got to tag on another 3.8% Medicare investment tax on investment income, which includes capital gains and dividends. Your investments are now tied to health care policy.

Suppose you make $350,000 (married) in income and generate $20,000 in capital gains and dividends this year. Since you fall into the 33% tax bracket, that $20,000 is subject to the 15% tax, but you have to add another 3.8% Medicare investment tax. And don’t forget state income tax (assume 5%). Your total capital gains/dividend tax bill: 23.8% or about $4,800.

Other taxes

Politicians like to use obtuse language like “expiration of tax cuts” when they are really talking about tax increases. Two more examples of this apply to the new tax law:

There is now a phaseout of itemized deductions, which include deductions such as mortgage interest, charitable contributions, and others. It applies only to income taxpayers making more than $300,000 (married). So the greater your income goes above that amount, the less deductions you can take. This phaseout indirectly pushes you into a higher income tax bracket.

The marriage penalty is back. Again, for higher income taxpayers you start falling into the higher income tax brackets sooner than you would if you remained two separate individuals. While I’m not suggesting you get divorced, it’s another example of a stealth tax.

The new tax law is a more progressive tax system designed to target higher income taxpayers. There are higher income tax rates, dividend tax rates, and capital gains tax rates on higher income individuals including EPs. There is also an interplay between new taxes (payroll taxes and Medicare investment tax) and income taxes, and hidden tactics that push your tax bracket even higher.

Practically speaking, unless your income has gone up significantly this year (doubtful), then you’ll either have to save less and potentially retire later, work more now to make up for it, or cut your current lifestyle. None are very appealing options.

Welcome to the new reality.

Setu Mazumdar, MD, CFP® practices EM and he is the president of Lotus Wealth Solutions in Atlanta, GA www.lotuswealthsolutions.com

9 Comments

The author fails to mention important facts like the limits on deductions (called the Pease limits) were originally passed in the 1990’s and were in effect until the bush tax cuts, yet somehow we still did ok in the 90’s. Or that the new top rate on those making more than $450k (where do you practice by the way, I want in…) is still lower than the top tax rate for the first 7 years of Regans presidency.

How about we just buy less stuff, smaller House, not so fancy car. If we can’t live on 200,000 or more than we’ll never be happy no matter what we make. Stop complaining about taxes and be happy we have the money to pay them. Do you dress up and go into battle for your country? Do you pave the roads? Do you take care of our national parks? Do you defend the streets at night from perpetrators ?

Please stop all the complaining when you have way more than 99% of the world.

Thanks for responses.

@Djk — not possible to go through past many years of tax laws in a short article. Purpose of the article is to summarize the new laws. Pease deductions were in effect then phased out but are now back. Reality is that the new tax law is specifically aimed at higher income earners and has made the tax system more progressive. No doubt about that one. It is not possible to extrapolate the new tax law and its effect on the markets or today’s economy based on the relationship between the tax law in 1990s and the economy/markets at that time. There are too many variables that effect economy and markets rather than just taxes. That doesn’t change the fact that the new law targets higher income earners. Also, I know a number of emergency physicians who make >$500k in income. Plus remember that you have to factor in spouse’s income. When you do that, the new tax law punishes married taxpayers to some extent. And remember that there is another huge tax on emergency physicians — it’s called EMTALA.

@Ben — you are welcome to pay more taxes if you’d like. Do you make a profit at the end of the year (income minus personal expenses)? Then you should simply donate that amount to the government if you feel like you aren’t paying enough and that you are making more than 99% of the world. I do agree with your statement to spend less. However I see no problem whatsoever with physicians who make high income. We provide an incredibly valuable service and we deserve high compensation for that service. When doctors deviate from that concept, you devalue your own services as a physician.

I have to agree with Ben. The wealthiest Americans (us) have a tax rate that is still astronomically lower than it was a half a century ago, and still lower than that of many wealthy nations. Sure, we do provide an “incredibly valuable service,” but not more so than police officers, fire fighters, social workers, teachers, etc. Yes, our education lasts longer and we accrue more student loans, but I still don’t agree that that justifies a disproportionately higher income. I, for one, am happy to pay my taxes. I would take no pleasure in having a bigger house or taking an extra vacation knowing that the poorest citizens of the country are being denied valuable social services so I can get a little extra money back from Uncle Sam. How much stuff do we really need, anyway?

@Liz — thanks for comments. Since you are “happy to pay taxes” do you take any deductions on your income tax return? In other words if you enjoy paying taxes so much and you take deductions or credits (whether it’s via retirement plan contributions, itemized deductions, foreign tax credit, etc.) then why do you claim those? By taking those deductions and/or credits, you reduce your tax bill which seems odd given you are happy to pay taxes, right? So I’m assuming on your income tax return you are NOT claiming any deductions or credits, right? Or are you? Taken to the extreme, we should all work for free (though EMTALA takes care of alot of that). Again, I agree with you that having modest personal expenses is a good idea for most physicians since we’re definitely not “rich.” However to say that physicians shouldn’t make a higher income simply devalues our services. That’s one of many reasons why doctors have lost autonomy in medicine.

Ya, less stuff, smaller house, not so fancy car. In fact, we should all give up our cars and ride bikes to work. Thats why we all did an extra 12 years of education and work our tails off day in and day out. For those of us who work extra to fill the gaps in the schedule, but feel okay about it because the compensation eases the stress, those days are gone. No one wants to work more to make less. This will only make shortages of ED physicians worse. It doesn’t concern me that I have to pay higher taxes if there is something to show for it in return. I am in the military reserve. As an officer I have to purchase my own uniforms and personal equipment. The military does not pay for it. I spend more on travel and expenses than my base salary so I essentially serve at my own expense….to help protect this country. But when people on section 8 housing subsidy, have food stamps, and get a subsidy to pay their utilities, are on Medicaid, but drive a nicer car than I do, have a new iPhone 5, smoke 2 packs a day, and live as good of a lifestyle as I do and don’t have to work a day, serve the public in any way, or give back to the community in order to get it, then I have a real big problem with paying higher taxes. But because I work more hours and harder, and make more money, I have to give more because our sad government can’t make it work on “less”. They can’t cut the fat enough to need “less”. They don’t want to take away anything from the entitled because THEY would have “less”. And no matter how one wants to call the author an Alarmist, the increases are going to occur. We are all going to pay considerably more in taxes while getting less for it.

Liz:

Why don’t you move to Cuba, or Venezuela?

They have the same mentality as you and, by the way, our own president, unfortunately.

@the author: I do claim deductions on my taxes, partially because we donate money to nonprofits, and, if given a choice, I’d rather give my money to small nonprofits whose work I admire than the federal government, but the goal is the same: I make more than enough money to live comfortably, it’s my responsibility to make sure those in my community are not homeless, hungry, or otherwise. I’m not saying physicians shouldn’t be compensated for the work that they/we do, I just think there’s a limit to the fairness of that compensation. My first year salary out of residency was literally three times what both of my parents (professionals with masters degrees) made combined during my entire childhood (which was very comfortable, for what it’s worth). That just doesn’t make sense.

@SM: And while there are certainly people who abuse the system (I work and live in a major city, I know who you’re talking about), that doesn’t mean the safety net for the most vulnerable Americans should be eliminated, just because there are those who abuse it.

@Walter: And as for moving to Cuba or Venezuela…no thanks. I like my area, most of my friends and family are here, and the weather is more palatable. But I see your point: you don’t see a difference between socialism and a fair society where the haves contribute to the care of the have-nots. I can still have a nice house, car, retirement savings, and take vacations, all without making (individually, not counting my gainfully-employed spouse) >10x what a family of four makes at the poverty line.

Liz,

Instead of “happily paying”, I would recommend you pay the least amount of taxes you can and give your money/time directly. Once the money is filtered through the huge bureaucracy, it is pennies on the dollar from where it started. It used to work this way, prior to the start of the “safety net”. See SM comments on how well the safety net is working.